Unmasking Forex Trading Scams: Protect Yourself from Fraud

In the sprawling world of finance, few avenues are as tantalizing as Forex trading. Promises of quick profits and the allure of being your own boss attract many individuals into this dynamic market. However, this landscape is also riddled with traps set by fraudsters keen on exploiting the uninformed and inexperienced. Understanding how to identify Forex trading scams is crucial for anyone looking to engage legitimately in the currency exchange market, and resources like forex trading scam https://onlinetrading-cm.com/ can provide valuable insights.

What is Forex Trading?

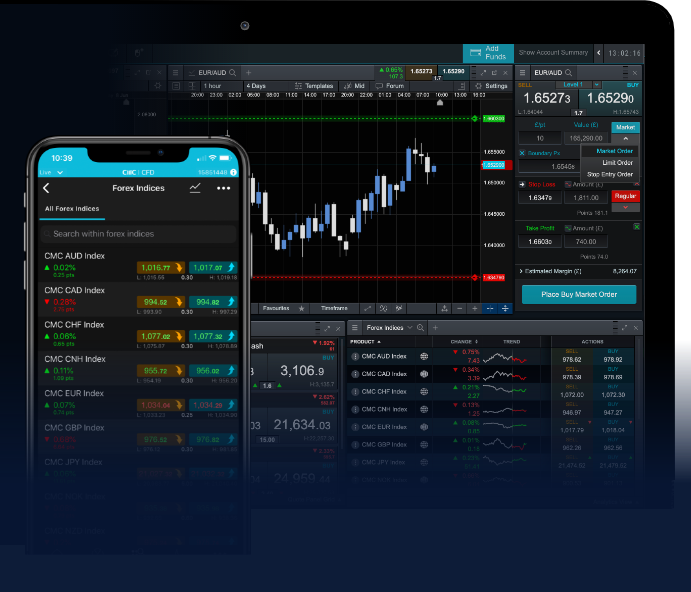

Forex, or foreign exchange, refers to the global marketplace for trading national currencies against one another. Unlike stock markets, Forex operates 24 hours a day, five days a week, showcasing volatility and liquidity that many traders crave. With the potential for high returns comes high risk; hence, a myriad of scams lurks around these benefits, waiting for unsuspecting traders.

The Rise of Forex Trading Scams

The rapid growth of the Forex market has not only attracted legitimate traders but also a subculture of fraud. According to various reports, billions of dollars are lost each year due to trading scams. The internet has facilitated the spread of these schemes, allowing scammers to target vulnerable and naive individuals globally. Common characteristics of Forex scams include promises of high returns, pressure to invest quickly, and minimal regulatory oversight.

Common Types of Forex Trading Scams

1. Ponzi Schemes

Ponzi schemes promise high returns with little risk, using the funds from new investors to pay earlier investors. This system collapses when the operator can no longer recruit new investors or misappropriates funds for personal use. These schemes may masquerade as investment firms or hedge funds claiming to trade in Forex markets.

2. Fake Trading Signals

Some scammers offer trading signals promising high success rates. For a fee, they provide ‘expert’ advice on which trades to make. However, these signals often lead to losses rather than gains, as they are generally not based on sound analysis but rather on misleading marketing tactics.

3. Unregulated Brokers

Many scam brokers operate without the necessary licenses or regulatory oversight. They often use enticing bonuses and promotional offers to lure traders into depositing funds. Once the money is deposited, it’s nearly impossible to withdraw it, leaving the traders with nothing but empty promises.

4. Phishing Scams

Phishing scams are designed to steal personal information and account credentials. Scammers may create fake websites that mimic legitimate trading platforms, tricking traders into entering sensitive data. Always ensure that URLs are secure and double-check before entering any personal information.

How to Spot Forex Trading Scams

Recognizing a Forex scam is essential for protecting your investments. Here are several red flags to watch for:

- Unrealistic promises: If something sounds too good to be true, it likely is. Promises of guaranteed returns or risk-free trading are strong indicators of a scam.

- Lack of transparency: Legitimate brokers are typically transparent about their operations. If a broker is unwilling to disclose information about their business or licensing, proceed with caution.

- High-pressure sales tactics: Scammers often use aggressive techniques to pressure potential investors into making quick decisions. Take your time to research any opportunity thoroughly.

- Vague or missing contact information: A legitimate trading firm will be easy to contact and provide verifiable addresses. If a company is hard to find or lacks clear contact details, it’s a warning sign.

Protecting Yourself from Forex Scams

Fortunately, there are steps you can take to protect yourself from Forex trading scams:

- Do your research: Never invest in a platform you haven’t thoroughly researched. Check reviews, look for complaints, and verify the regulatory status of brokers.

- Use demo accounts: Most legitimate brokers offer demo accounts to practice trading without real money. Test the platform and its features before committing funds.

- Verify licenses: Ensure that the broker you choose is properly licensed and regulated by a recognized financial authority.

- Stay informed: Keep up with the latest trends and scams in Forex trading by reading financial news and community forums.

Conclusion

As you consider entering the world of Forex trading, staying vigilant against scams is imperative. By understanding the common tactics used by fraudsters and employing sound practices to protect yourself, you can significantly reduce your risk of falling victim to a Forex trading scam. Awareness and education remain your best defenses in navigating this complex and often perilous market.